You can also use Synder to help you track both short-term and long-term liabilities. For instance, it can manage accounts payable by automatically recording invoices from integrated platforms. In contrast, permanent accounts record assets, liabilities, and equity. At the beginning of an accounting period, these accounts carry forward the ending balance from the previous period.

Which 4 accounts are considered temporary accounts?

Unlike temporary accounts, asset balances carry over from one accounting period to the next and reflect the company’s financial position over time. On the contrary, permanent accounts do not close at the end of the accounting period. Their balances carry over from one period to the next, accumulating over the company’s lifetime. Temporary accounts (or nominal accounts) include all of the revenue accounts, expense accounts, the owner’s drawing account, and the income summary account. Generally speaking, the balances in temporary accounts increase throughout the accounting year. At the end of the accounting year the balances will be transferred to the owner’s capital account or to a corporation’s retained earnings account.

Stay up to date on the latest accounting tips and training

Also known as nominal accounts, temporary accounts are fundamental tools for recording and summarizing the financial activities of a business within a single accounting period. Their primary role is to gather data related to income, expenses, and dividends, offering insights into the performance of the business during that time frame. Automation tools often include features for detecting and correcting errors in real-time. For both temporary and permanent accounts, this means that any discrepancies or anomalies can be identified and addressed quickly, reducing the risk of inaccurate financial reporting. In sole proprietorships and partnerships, drawing accounts track withdrawals taken by owners for personal use. In corporations, dividend accounts record the profits distributed to shareholders.

Temporary Account Examples

- For example net sales is gross sales minus the sales returns, the sales allowances, and the sales discounts.

- Permanent accounts include asset, liability, and equity accounts, all included in the balance sheet.

- The company owes $21,474 after this payment, which is $31,450 – $9,976.

At the end of each accounting period, temporary accounts are closed and reset to zero. Conversely, permanent accounts are never closed; they carry their balances forward into the next accounting period. HighRadius’ Record to Report Solution significantly enhances the management of both temporary and permanent accounts by automating key processes and ensuring real-time accuracy. It streamlines the closing process for temporary accounts, accelerates financial reporting with real-time updates, and reduces manual errors through automated data entry and reconciliation.

Harnessing the power of Synder for better management of your accounts

The discount on notes payable in above entry represents the cost of obtaining a loan of $100,000 for a period of 3 months. Therefore, it should be charged to expense over the life of the note rather than at the time of obtaining the loan. Closing entries are not needed when using accounting software like QuickBooks, Xero, or Freshbooks.

Long-Term Notes Payable, Interest, and the Time Value of Money

There is no such thing as a temporary account with no retained earnings. Every year, all income statements and dividend accounts are transferred to retained earnings, a permanent account that can be carried forward on the balance sheet. As a result, all income statements and dividend accounts are transitory.

When this happens, it can cause the company to miscalculate everything else, which could lead to overpaying or underpaying other financial obligations. In addition, the amount of interest charged is recorded as part of the initial journal entry as Interest Expense. The amount of interest reduces the amount of cash that the borrower receives up is notes payable a permanent or temporary account front. On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $102,250, 3 month, zero-interest-bearing note. National Company prepares its financial statements on December 31, each year. On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $100,000, 6%, 3 month note.

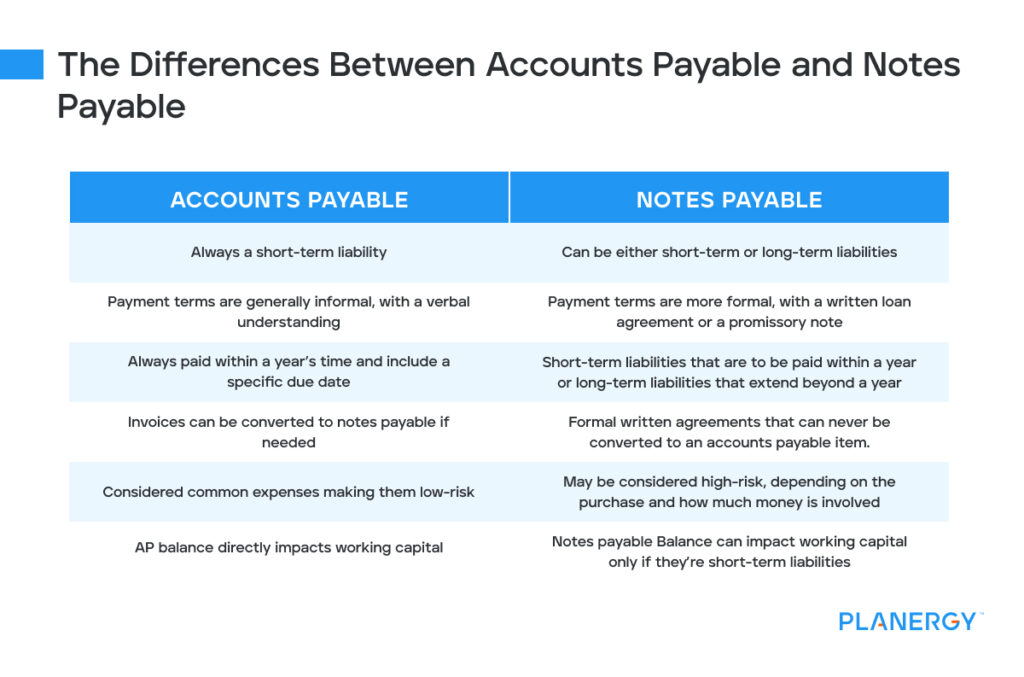

Permanent accounts are the balance sheet accounts, Assets, Liabilities, and Equity. You create the note payable and agree to make payments each month along with $100 interest. In your notes payable account, the record typically specifies the principal amount, due date, and interest. Once you create a note payable and record the details, you must record the loan as a note payable on your balance sheet (which we’ll discuss later). Temporary accounts play a critical role in the creation of financial statements, especially the income statement and the statement of retained earnings. Temporary accounts, true to their name, do not carry forward their balances to the next accounting period.